Depending on your age, you may or may not recall the last large-scale American bailout of the banking sector.

October 2008.

The Troubled Asset Relief Program.

TARP (!)

$700 billion.

Approved with a bipartisan touch (74 Senate votes.)

And signed into law by President George W. Bush – an instinctual opponent to government intervention except to avert this very specific financial calamity that could have rivaled the Great Depression. That’s how the urgency was sold.

“I believe companies that make bad decisions should be allowed to go out of business,” Bush said. “Under normal circumstances, I would have followed this course. But these are not normal circumstances.”

The collapse of Silicon Valley Bank, or #SVB, in the winter of 2023 doesn’t exactly rise to the magnitude of the fall of 2008, which enveloped numerous sizable financial institutions.

But if you listen to investors, venture capitalists and financial savants (I.E.: rich folk), the failure of a $200 billion consumer tech bank that backed half of the country’s start-ups, isn’t normal either. And shouldn’t be considered so.

The most panicked cried that it was an extinction level Black Swan event!

To which, most politicians – on the left and right – replied: Too bad.

There doesn’t appear to be any sort of bailout coming from Washington – or enthusiasm for one from those who aspire to occupy #ThisTown a couple years from now.

And that’s a radical political change within 15 years.

Biden couldn’t get 74 votes in the Senate for any type of bailout. It’s unlikely he’d even want to try, given his treasury secretary’s initial reaction to SVB’s death. Florida Gov. Ron DeSantis, one of the three men most likely to be the next president, blamed diversity and equity policies for the bank’s collapse, criticized the federal bureaucracy for failing to stop it and then openly wondered if there was anything it could do anyway.

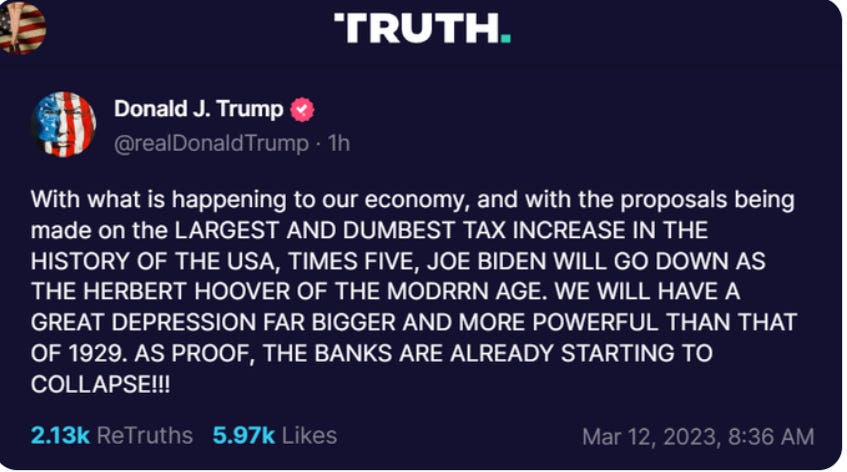

Former President Donald Trump summarily blamed Biden IN ALL CAPS.

Republican presidential contender Nikki Haley adopted the easy, no bailout approach in her four-sentence statement.

Sen. Bernie Sanders devoted three paragraphs to it, outlining Trump era deregulation as the cause, but essentially said the same thing on #SVB: “Now is not the time for U.S. taxpayers to bail out Silicon Valley Bank.” (Sanders was one of 25 senators to oppose TARP in ‘08)

Want an issue you can earn bipartisan hold-handing? It’s bashing bankers and swatting away bailout talk with the revulsion of a circling mosquito.

Now, the more nuanced argument here is that you can let the bank die and punish its executives for mismanagement –,but must protect the depositors, the seemingly innocent start-up bros and gals who trusted their dollars would be secure and liquid in America’s 16th biggest bank.

These are real people, not bigwigs, howled the rich folk! They are employees and vendors who will be most hurt, not multimillionaires and VCs.

Enter Vivek Ramaswamy, an Ohio-based entrepreneur, who just happens to also be seeking the 2024 Republican nomination.

As someone steeped in the investment sector, he has offered the most substantial comments on #SVB of any of the White House contenders so far – and has proposed the toughest Laissez-faire approach of anyone in the discourse.

“I would not bail out either SVB – or even the depositors,” Ramaswamy said on CNN Sunday.

He expounds >

And even on behalf of many start-up companies who put their money in a concentrated way into that one bank, I don't think we should be rewarding that with a bailout. And I'm consistent. I was also against the student loan bailouts that President Biden's proposed. But I think you can't talk out of both sides of your mouth, saying that Silicon Valley Bank deserves to be bailed out, while people who hold student loans shouldn't …. I think that, actually, we should let the market work here, let Silicon Valley Bank fail, if needed … If another bank actually wants to buy and save Silicon Valley Bank through the private sector itself, they should be permitted to do that.”

The betting is on a private purchase of SVB by Monday or shortly thereafter, being nudged along and facilitated by the federal government.

This buyer would be one of the even more loathed BIG Banks – likely based in New York – that would add Silicon Valley VCs to its gargantuan portfolio.

This scenario bails out the government in a country that has no love for bailouts, yet at the same time exacerbates the problem of creating the ballooning institutions that created the much more dire 2008 apocalyptic-extinction level event.

You see, saving SVB likely means assisting another bank becoming Too Big To Fail.

What will our politicians choose to do if it teeters toward insolvency one day?

The politics of 2008 that allowed a government fix is what’s actually extinct.